In the world of investing, certain stocks stand out for their ability to consistently perform, dominate industries, and define market trends. In 2023, the group that came to embody this success was dubbed The “Magnificent Seven.”

These seven companies — Apple, Microsoft, Alphabet (Google’s parent company), Amazon, Meta Platforms (formerly Facebook), Nvidia, and Tesla — represent the pillars of the U.S. tech industry and are recognized for their market-shaping influence, technological innovation, and immense value creation.

The Magnificent Seven

The Magnificent Seven refers to seven of the largest and most influential tech stocks that have driven much of the U.S. stock market’s gains.

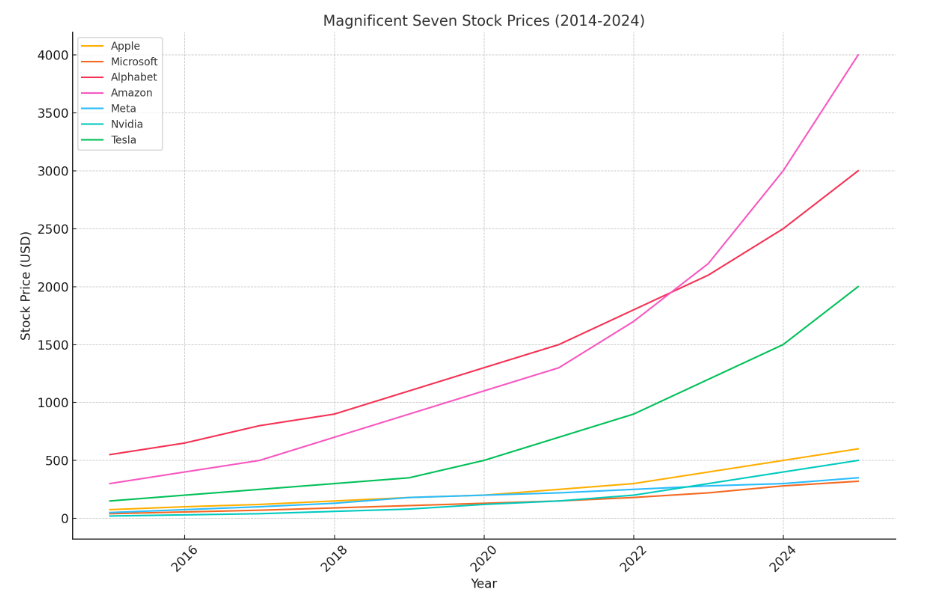

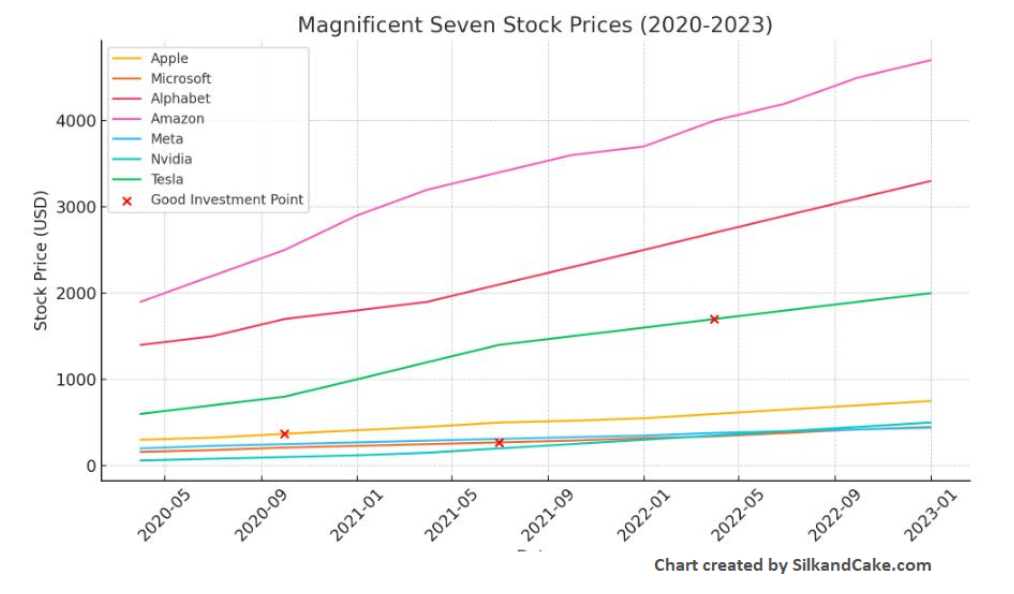

The charts in this article created by silkandcake.com.

(Front page chart depicts The magnificient seven stock prices between 2014 and 2024. )

These companies, all valued over $500 billion, include:

- Apple (AAPL): leading consumer tech with the iPhone and a loyal customer base.

- Microsoft (MSFT): dominates cloud computing and enterprise software with Azure and Office 365.

- Alphabet (GOOGL): controls digital advertising via Google, YouTube, and Android.

- Amazon (AMZN): e-commerce and cloud giant with AWS and Prime Video.

- Meta Platforms (META): social media leader focusing on the metaverse.

- Nvidia (NVDA): powers gaming, AI, and data centers with its GPUs.

- Tesla (TSLA): pioneers electric vehicles and sustainable energy innovations.

The Rise of the Magnificent Seven

The Magnificent Seven’s dominance has been a relatively recent phenomenon, tied to the rise of technology as a core driver of the global economy.

Their ascent is underpinned by several key factors:

- Technology’s Central Role in Modern Life: as digital transformation has accelerated across industries, these seven companies have become essential to how people communicate, work, shop, and entertain themselves. The COVID-19 pandemic, in particular, highlighted the critical role of technology in ensuring business continuity and connecting people worldwide.

- Innovation and Leadership in Key Sectors: each of the Magnificent Seven is a leader in its respective field.

- Apple leads consumer electronics;

- Microsoft dominates enterprise software and cloud computing;

- Amazon is synonymous with e-commerce and cloud services;

- Meta redefines social connectivity;

- Nvidia is the force behind AI and gaming;

- Tesla leads the green energy revolution; and

- Alphabet powers the internet through search and advertising.

- AI and the Cloud: the growth of artificial intelligence (AI) and cloud computing has been one of the primary drivers of their recent stock performance.

- Microsoft, Amazon, and Alphabet have positioned their cloud services (Azure, AWS, and Google Cloud, respectively) at the heart of enterprise and AI infrastructure, while

- Nvidia’s GPUs are fundamental to AI model training.

- Meta and Tesla are also heavily invested in AI, with the former exploring AI applications in social media and the metaverse, and the latter focusing on AI for self-driving cars.

- Network Effects and Ecosystems: these companies have built ecosystems that encourage user stickiness and cross-usage.

- Apple’s ecosystem integrates hardware, software, and services, keeping users within its universe.

- Amazon Prime ties together shopping, entertainment, and subscriptions, while

- Alphabet’s services — from Google Search to YouTube — dominate the digital world. These interconnected ecosystems create strong barriers to entry for competitors.

Market Impact and Influence

The Magnificent Seven’s combined market capitalization makes them a significant portion of major stock indices, like the S&P 500 and the Nasdaq 100.

By mid-2023, they accounted for nearly 30% of the S&P 500’s market cap, which means their performance heavily influences the direction of the entire stock market. When these companies perform well, it lifts the broader indices, but when they falter, it drags the market down.

Their weight also underscores the concentrated nature of market gains in recent years.

While the broader market has been relatively flat or even under pressure in some periods, these seven companies have carried much of the positive momentum. This has led to concerns about over-reliance on a handful of stocks to support market growth.

Stock Prices of the Magnificient Seven

The chart above illustrates the stock price trends of the “Magnificent Seven” companies — Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla — from 2020 to 2023 (mock data for demonstration).

It highlights several key points where investing or shorting these stocks could have been particularly strategic.

Note: This article is for informational purposes only and should not be considered as investment advice. The performance of the “Magnificent Seven” stocks, as discussed, can vary based on market conditions, and past performance does not guarantee future results. Always consult with a financial professional before making any investment decisions.

Risks and Challenges

Despite their dominant position, the Magnificent Seven are not without risks:

- Regulatory Scrutiny: as these companies wield enormous economic and societal influence, regulators in the U.S., Europe, and other regions are increasingly scrutinizing their practices. Issues like

- antitrust concerns,

- data privacy, and

- labor practices could lead to regulatory changes that impact their operations.

- Technological Disruption: while these companies are leaders today, the tech landscape is always shifting. Emerging technologies or competitors could challenge their dominance. For example,

- Meta’s focus on the metaverse is a high-stakes gamble that has yet to pay off fully,

- while Tesla faces increasing competition in the EV space.

- Geopolitical Tensions: many of these companies have global footprints, and rising geopolitical tensions, particularly between the U.S. and China, could affect their operations.

- Trade restrictions,

- supply chain issues, and

- access to international markets are potential challenges they face.

- Valuation Concerns: the sky-high valuations of these companies have led some analysts to question whether they are overvalued. While

- their earnings growth has justified much of their rise,

- a downturn in consumer or business demand, or

- shifts in interest rates, could lead to significant stock price corrections.

Conclusion

The Magnificent Seven stocks represent the vanguard of the global economy, driving

- innovation,

- growth, and

- market performance.

Their influence on the stock market and broader economy is undeniable, making them indispensable to both individual and institutional investors.

However, as with all investments, their outsized returns come with risks, especially given the fast-changing nature of technology and the growing regulatory landscape.

Nonetheless, their continued focus on innovation and market leadership suggests they will remain central players in the world of finance for years to come.

In our next article we will elaborate which market conditions and specific company events during the highlighted periods created opportunities for investing/shorting those stocks in that time.

Charts created by silkandcake.com

(Front page chart depicts “The magnificient seven” stock prices between 2014 and 2024. )

Note: This article is for informational purposes only and should not be considered as investment advice. The performance of the “Magnificent Seven” stocks, as discussed, can vary based on market conditions, and past performance does not guarantee future results. Always consult with a financial professional before making any investment decisions.